A digital evolution helping to connect with and empower members

Worcestershire Pension Fund

Worcestershire Pension Fund (the Fund) looks after 66,000 members across 190 scheme employers with combined assets worth over £3.7bn.

The Fund’s top priority is paying pensions and its purpose is to deliver on the benefit expectations of members by managing investments to increase assets and by understanding liabilities.

Overview

Worcestershire Pension Fund has been a Heywood customer for over 35 years, with the Fund having put their faith in Heywood pension administration platform Altair since 2015, and its previous iteration, AxisE, before that.

In 2022, the Fund underwent a restructuring of its administrative function and implemented several additional roles into the team. This proved to be the catalyst for a systems evolution.

Although the Fund had minimal backlogs and the quality of data held was extremely positive, implementing technology into processes needed to be improved. As such, the Fund embarked on a project to understand and review existing processes, and where possible, embrace technology and automation tools to help drive efficiency.

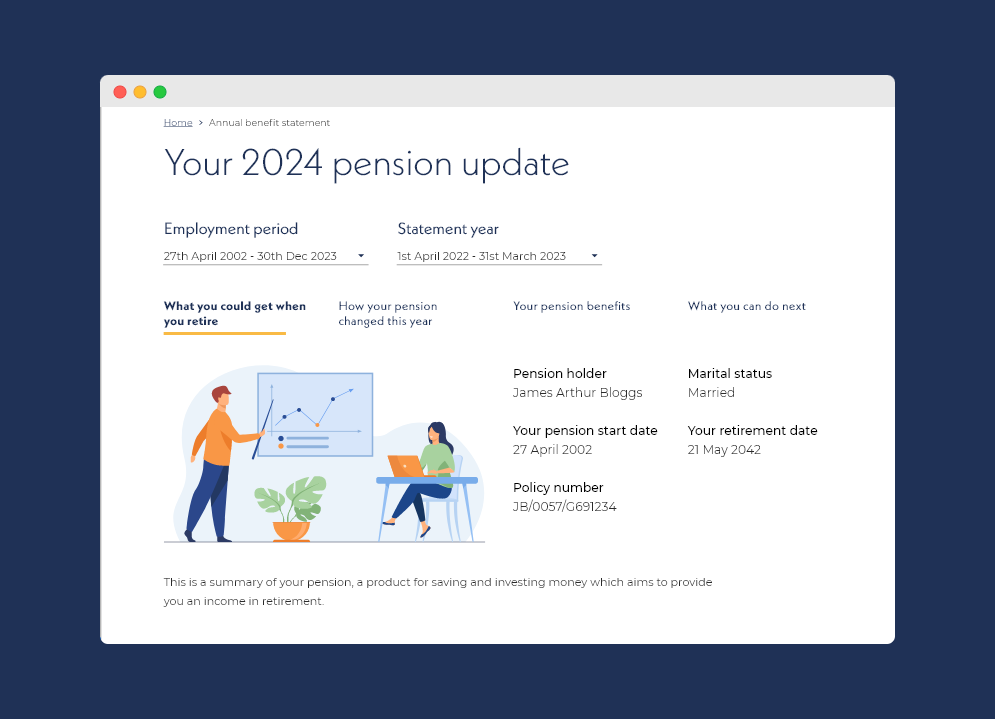

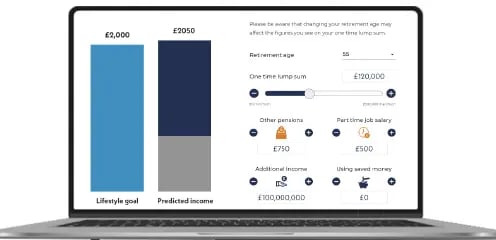

At the time, the Fund did not have a member self-service platform, and as a result, the first stage of its technology evolution was to implement Heywood Engage, Heywood’s new member engagement platform that would allow them to connect with members and empower them to oversee their pension information confidently and securely in one place.

The project

Historically, Worcestershire Pension Fund had no dedicated resource for systems development. This task, alongside several more, was undertaken exclusively by the Membership Manager.

As part of the Fund’s restructuring, a Systems and Projects team was created to support the delivery of process improvements.

The Fund wanted to change how they engage with members and faced a challenge in maximising the roll out of Heywood Engage as they had no prior experience of self-service functionality.

Having witnessed the power and potential of Engage via product workshops, the Fund was motivated to highlight the shift in focus towards technology by becoming an early adopter. They wanted to embrace technology and functionality and bring this to fruition quickly.

Our approach

To help the Fund move forward with the project, Heywood developed a clear timeline and established dedicated resources to complement the Fund’s in-house team.

Heywood organised regular weekly meetings to enable ongoing dialogue between project and technical teams, helping to ensure the project remained on track.

From the Fund's point of view, assembling a project team dedicated to delivering the project was vital. This allowed for comprehensive testing to be carried out efficiently and having a dedicated resource made delivering this straightforward.

As Engage transitioned to the deployment stage, the Fund worked in collaboration with Heywood and third-party pension communication experts and Heywood partner Quietroom to develop templates that would help the Fund develop clear, jargon-free communications to distribute to members, with the aim of maximising the take-up of registrations from launch.

The results

Between 18 February and 31 March 2024, Engage was launched to all active members via a letter with an activation key which included a link to the Fund’s website.

In the first 10 days of April, 6,992 members registered for the platform, representing an impressive 30% of the total active membership. Additionally, total website pageviews and users were up 35% and total session volume up 41% year on year.

On top of strong usage numbers, the Fund received outstanding feedback from its members through a feedback survey, achieving an average score of 4.08/5.00. Members identified the clear layout and easy navigation as a strength of the new platform which made it easy for them to do what they wanted.

Following the successful launch to active members, the Fund plans to launch Engage to deferred and pensioner members during Q2 of 2024.

Project snapshot

6,992 registered users

Within the first 10 days following the launch nearly 7,000 active members had registered for Engage

Pageviews up 35%

Total website pageviews were up 35% as members utilised the Fund's digital tools

41% increase in website sessions

Total website session volume rose 41% year on year

4.08/5 feedback score

The Fund received outstanding feedback from its members through a feedback survey, achieving an average score of 4.08/5.00

An evolution in member experiences

Heywood Engage revolutionises how pension schemes connect with members and empowers them to confidently and securely oversee their pension information.

Worcestershire Pension Fund were one of the first to take advantage of this innovative new platform.

Benefits to Worcestershire Pension Fund

- Improved digital engagement with members

Improved digital channels have boosted member engagement as they can now view and receive pension information online when they want it - Reduced paper usage boosts ESG credentials

Using Engage and integrating it into plans for process improvements has drastically reduced paper usage and saved the Fund money as a result Improvement in data accuracy due to self-service

Following the launch of Engage, members have taken an active role in updating their personal information

The member experience

“Thank you for getting this online. It makes it so much easier to access the information and is presented in a helpful way. I've recently been looking at my pension information to help me plan for the future and this will help with future scenarios without having to ask staff to spend time pulling figures out. I'll spend more time later working through the details but for now positive progress.”

- Worcestershire Pension Fund Member

.png)